Large taxpayers will continue to file the GSTR-3B during the months of October and November 2019, after which they will have to start filing FORM GST RET-01.

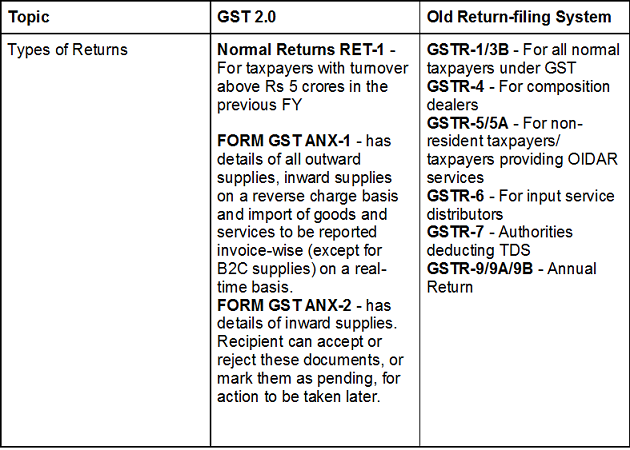

As proposed by the GST Council, a trial run of the new return filing mechanism called the GST 2.0 is expected to be launched starting July 2019. A full scale launch is likely to begin in a phased manner starting October 2019. Under the new return system there is one basic return and 2 annexures.

FORM GST RET-1 this return form has details of the supplies made. To be filed monthly (Small taxpayers with annual turnover upto Rs 5 crore, will have the option to file returns quarterly.)

Annexures

FORM GST ANX-1 - has details of all outward supplies, inward supplies on a reverse charge basis and import of goods and services to be reported invoice-wise (except for B2C supplies) on a real-time basis.

FORM GST ANX-2 - has details of inward supplies. Recipient can accept or reject these documents, or mark them as pending, for action to be taken later.

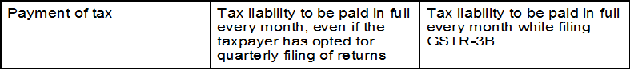

Tax will need to be paid on a monthly basis by all taxpayers.

Key Changes

- Uploading of invoices on an ongoing basis and accept/reject by buyer - One of the key changes is the mechanism to upload invoices in real-time by a supplier, which will be available for the buyer to view simultaneously and take action on in FORM GST ANX-2. The invoices can be marked as accepted or rejected by the buyer, or the same can be kept pending for action to be taken at a later date.

- Provisional credit - In the event a supplier does not upload invoices or file his return, there will be a mechanism for availing input tax credit by the recipient on a provisional basis. The credit available in such cases would not be more than 20% of the specified value. There is no provisional credit allowed in the current system.

- Amendment returns - The new return system will have a provision to file two amendment returns for each tax period. The old system did not allow this and the only option available to taxpayers was to amend certain details in the GST return of the following period. Now, as an amendment return can be filed for the same tax period, interest on the amended tax liability may be avoided or reduced.

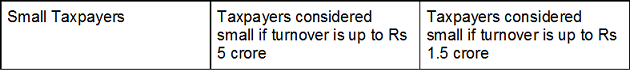

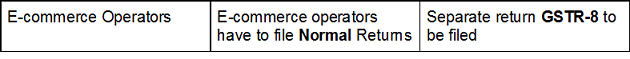

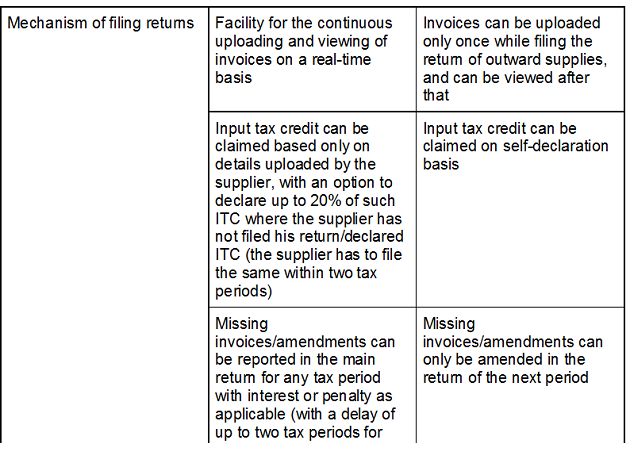

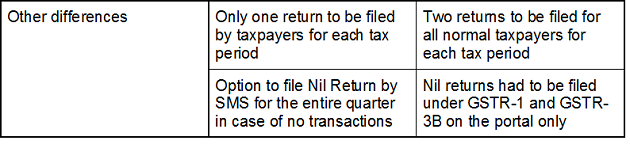

The differences between the two return filing systems can be seen below

Timeline of changes

From July 2019

The new return system will be implemented on a trial basis where a supplier will be able to upload invoices using the FORM GST ANX-1, and the recipient will be able to view and download the invoices of inward supply.

July to September 2019

Trial period where users can make themselves familiar with the annexure forms GST ANX-1 and GST ANX-2, and will continue to file GSTR-1 and GSTR-3B.

From October 2019

FORM GST ANX-1 will be made compulsory to be filed by large taxpayers (annual turnover more than Rs. 5 Crore), and it will replace the GSTR-1 return entirely. For small taxpayers, FORM GST ANX-1 will be implemented from January 2020, which will be for the quarter October to December, 2019.

Large taxpayers will continue to file the GSTR-3B during the months of October and November 2019, after which they will have to have to start filing FORM GST RET-01, the main return in the new return system, which will need to be filed by the 20th of January 2020. In the case of small taxpayers, they will need to stop filing GSTR-3B and start filing FORM GST PMT-08 from the month of October 2019, which will be the form for self-declaration of taxes and the payment of the same. The plan is to phase out GSTR-3B from January 2020 onwards, by which all taxpayers shall be filing FORM GST RET-01.

Published On : 17-06-2019

Source : Economic Times