New Delhi: The International Monetary Fund (IMF) on Tuesday cut India’s GDP growth forecast for 2019-20, following similar action by the Asian Development Bank (ADB) and the Reserve Bank of India (RBI).

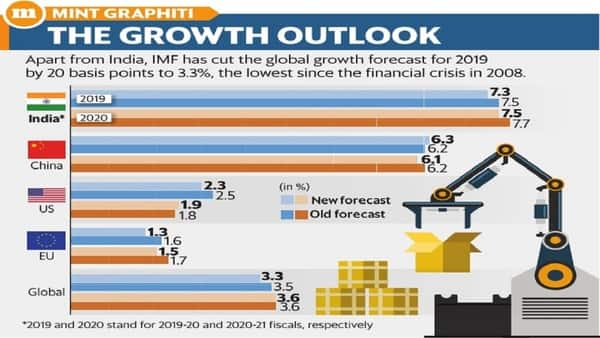

“In India, growth is projected to pick up to 7.3% in 2019 (2019-20) and 7.5% in 2020, supported by the continued recovery of investment and robust consumption amid a more expansionary stance of monetary policy and some expected impetus from fiscal policy," IMF said in its World Economic Outlook report released on Tuesday.

IMF’s downward revisions in India’s growth forecasts are 20 basis points each in 2019-20 and 2020-21 from its outlook released in January.

One basis point is one-hundredth of a percentage point.

Both ADB and RBI last week cut their 2019-20 growth projection for India to 7.2% from 7.4% earlier, blaming rising risks to global economic growth as well as weakening domestic investment activity.

The Indian economy grew 6.6% in the December quarter, the slowest in five quarters. That prompted the Central Statistics Office (CSO) to trim its 2018-19 forecast to 7% in February from 7.2% estimated in the previous month.

With the Indian economy projected to slow down further in the fiscal fourth quarter, the central bank’s focus has shifted from inflationary concerns to sustaining the growth momentum. RBI effected two back-to-back rate cuts of 25 basis points each to boost growth.

Of the high-frequency indicators of industry, growth in the manufacturing component of the index of industrial production slowed to 1.3% in January. Growth of eight core industries remained sluggish at 2.1% in February. Data released by the Society of Indian Automobile Manufacturers on Monday signalled a slowdown in urban demand as car sales grew 2.7% in 2018-19, the worst performance in five financial years.

Agenda for the next government

Setting the agenda for the next government, to be formed after general election results are declared on 23 May, IMF said continued implementation of structural and financial sector reforms with efforts to reduce public debt remain essential to secure the Indian economy’s growth prospects.

“In the near term, continued fiscal consolidation is needed to bring down India’s elevated public debt. This should be supported by strengthening goods and services tax compliance and further reducing subsidies," IMF said in its World Economic Outlook.

The report emphasized enhancing governance of public sector banks and reforms to hiring and dismissal regulations that would incentivize job creation and absorb the country’s large demographic dividend. “Efforts should also be enhanced on land reform to facilitate and expedite infrastructure development," the report stated.

IMF commended the government for taking steps to strengthen financial sector balance sheets through accelerated resolution of non-performing assets (NPAs) under a simplified bankruptcy framework.

Global Risks

IMF also cut its global growth forecast for 2019 by 20 basis points to 3.3%—the lowest since the financial crisis in 2008—blaming trade tensions between the US and China, loss of momentum in Europe and uncertainty surrounding Brexit. It, however, raised China’s GDP growth outlook by 10 basis points to 6.3% for 2019.

Beyond 2020, the report said global growth would be sustained at about 3.6% because of the increase in the relative size of economies such as China and India, which are projected to have robust growth.

“Growth in India is expected to stabilize at just under 7.75% over the medium term, based on continued implementation of structural reforms and easing of infrastructure bottlenecks," the report added.

IMF chief economist Gita Gopinath said global growth should rebound if the downside risks do not materialize and the policy support that is put in place is effective.

“If, however, any of the major risks materialize, then the expected recoveries in stressed economies, export-dependent economies and highly indebted economies may be derailed. In that case, policymakers will need to adjust. Depending on circumstances, this may require synchronized, though country-specific fiscal stimulus across economies, complemented by accommodative monetary policy," she added.

Published on : 10-04-2019

Source: Live Mint