Budget 2020: Things to watch out for the banking sector, Axis Bank says stressed asset pool back to 'normal' levels.

Just as the government prepares to announce the Union Budget 2020-21, the Reserve Bank of India (RBI) Governor has called for more structural, fiscal measures to boost demand and economic growth in the country, citing limitation in the monetary policy to do so on its own.

He added that steps like prioritising food processing industries, tourism, e-commerce, startups and efforts to become a part of the global value chain could give significant push to growth.

This week a number of private lenders like ICICI Bank, Kotak Mahindra Bank and Axis Bank announced their third quarter results. While their profits showed improvement, slippages still continue to remain elevated.

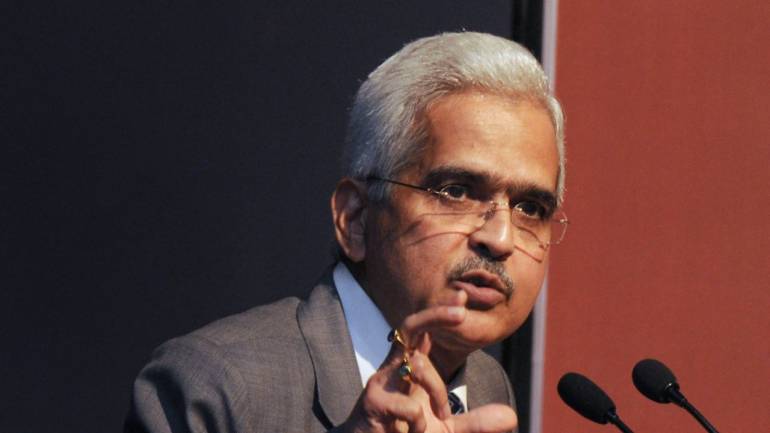

Need structural, fiscal measures to boost demand and growth: RBI Governor Shaktikanta Das

The Reserve Bank of India (RBI) Governor Shaktikanta Das said that there is need for structural and fiscal measures along with monetary policy to augment demand and growth in the economy. "Monetary policy, however, has its own limits. Structural reforms and fiscal measures may have to be continued and further activated to provide a durable push to demand and boost growth," Das said on January 24.

ICICI Bank classifies Karvy as NPA, slippages rise

ICICI Bank ,that posted 158.4 percent growth in net profit for October-December, mostly on account of recoveries from Essar Steel, saw two other big slippages in the third quarter, including its exposure to Karvy Stock Broking.

Budget 2020: Things to watch out for the banking sector

Apart from bank recapitalisation that the government has already prioritised for the merging lenders, there may not be much in store that could directly impact the sector in Budget 2020. However, due to the banking sector’s linkages to all other sectors in the economy, they may be affected by the Centre’s decision on sectors where they have a reasonable exposure. And there could be more downside risks than benefits due to these measures.

Axis Bank says stressed asset pool back to 'normal' levels

Axis Bank on January 22 reported lower-than-expected net profit for the October-December quarter on the back of higher provisioning. The private lender said that it may continue to set aside more against bad loans going ahead, as slippages remain high.

Kotak Mahindra Bank goes slow on loan growth as slippages remain highKotak Mahindra Bank that posted a lackluster credit growth of 10 percent in the third quarter, expects the pace to remain tepid going ahead, as it plans to stay cautious amid steady additions to bad loans.

Published On : 26-01-2020

Source : Money Control